CBAM and India's Steel Industry: Pioneering the Shift with Carbon Capture Solutions

In the wake of global environmental concerns, regulatory mechanisms like the Carbon Border Adjustment Mechanism (CBAM) have emerged. The CBAM, proposed by the European Union, is a tax imposed on carbon emissions associated with imported goods (1). It aims to prevent 'carbon leakage'—where producers move to regions with less strict emission controls—and incentivize sustainable practices globally.

For India's steel industry, the world's second-largest (2), the CBAM presents unique challenges and opportunities. This sector, accounting for approximately 7% of India's total greenhouse gas emissions (3), must adapt to the impending CBAM to maintain its global standing. Should India's steel industry fail to reduce its carbon footprint, the financial impact of the CBAM could be significant, potentially affecting its competitiveness in key markets such as the EU.

To mitigate this, Carbon Capture Solutions emerge as a crucial pathway. These technologies, designed to capture and store or utilize carbon dioxide emissions, could drastically reduce the industry's carbon footprint (4). By adopting these solutions, India's steel industry can align with the CBAM, potentially bypassing carbon costs and ensuring its products remain competitive in markets enforcing such regulations.

Moreover, investment in Carbon Capture Solutions could trigger a wave of technological innovation and job creation, contributing positively to India's growing green economy. Hence, in the broader perspective of the CBAM, Carbon Capture Solutions not only become a means of regulatory alignment but also signify a transformative step towards a sustainable future.

The Need for Carbon Capture Solutions in India's Steel Industry

The steel industry, at its heart, is an energy-intensive sector and contributes significantly to global greenhouse gas emissions. India, as the second-largest steel producer globally (1), has a correspondingly large carbon footprint. In 2022, the country's steel sector was responsible for approximately 250 million tons of CO2 emissions (5), accounting for about 7% of India's total greenhouse gas emissions (3).

Source: NITI AAYOG

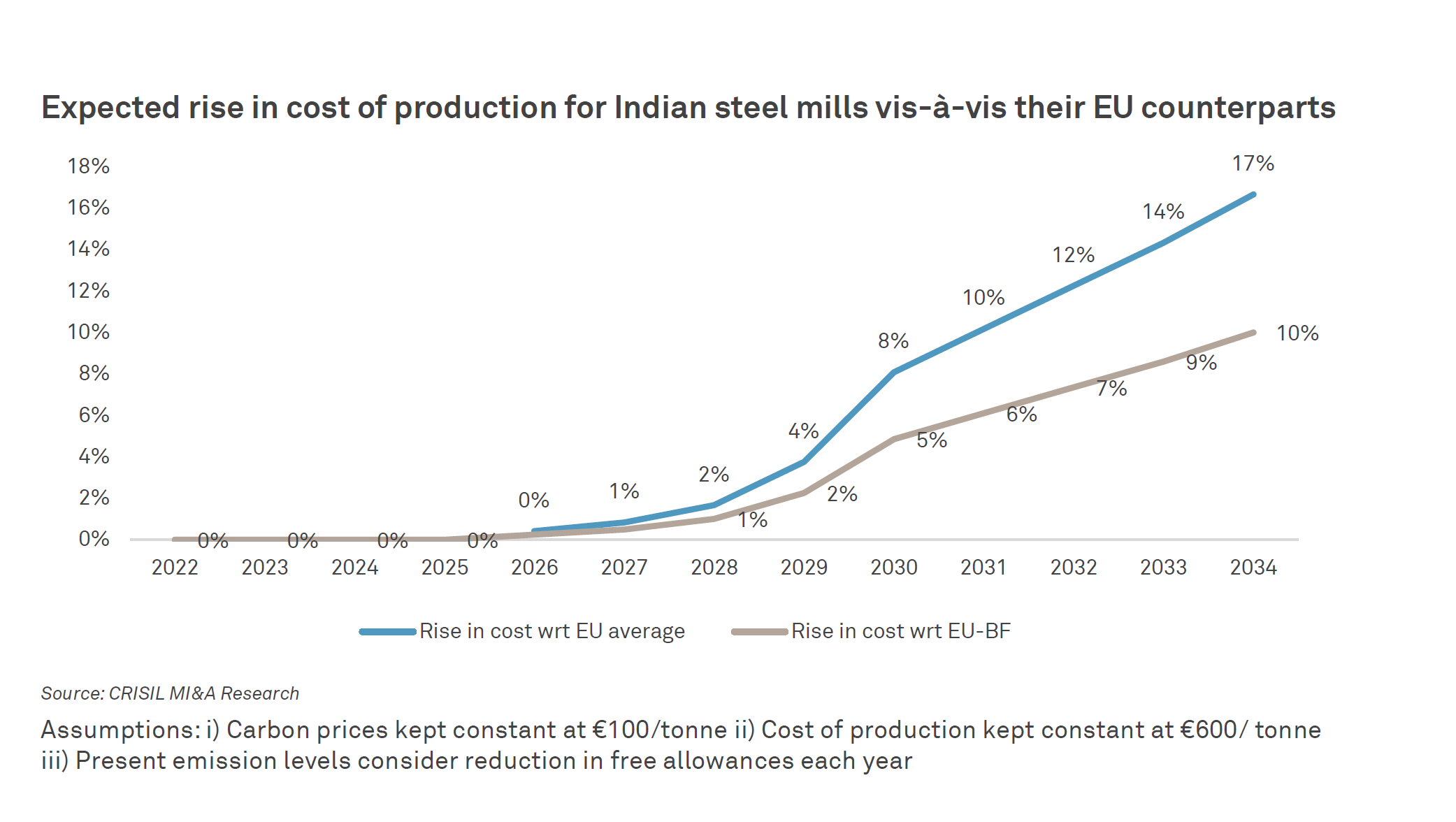

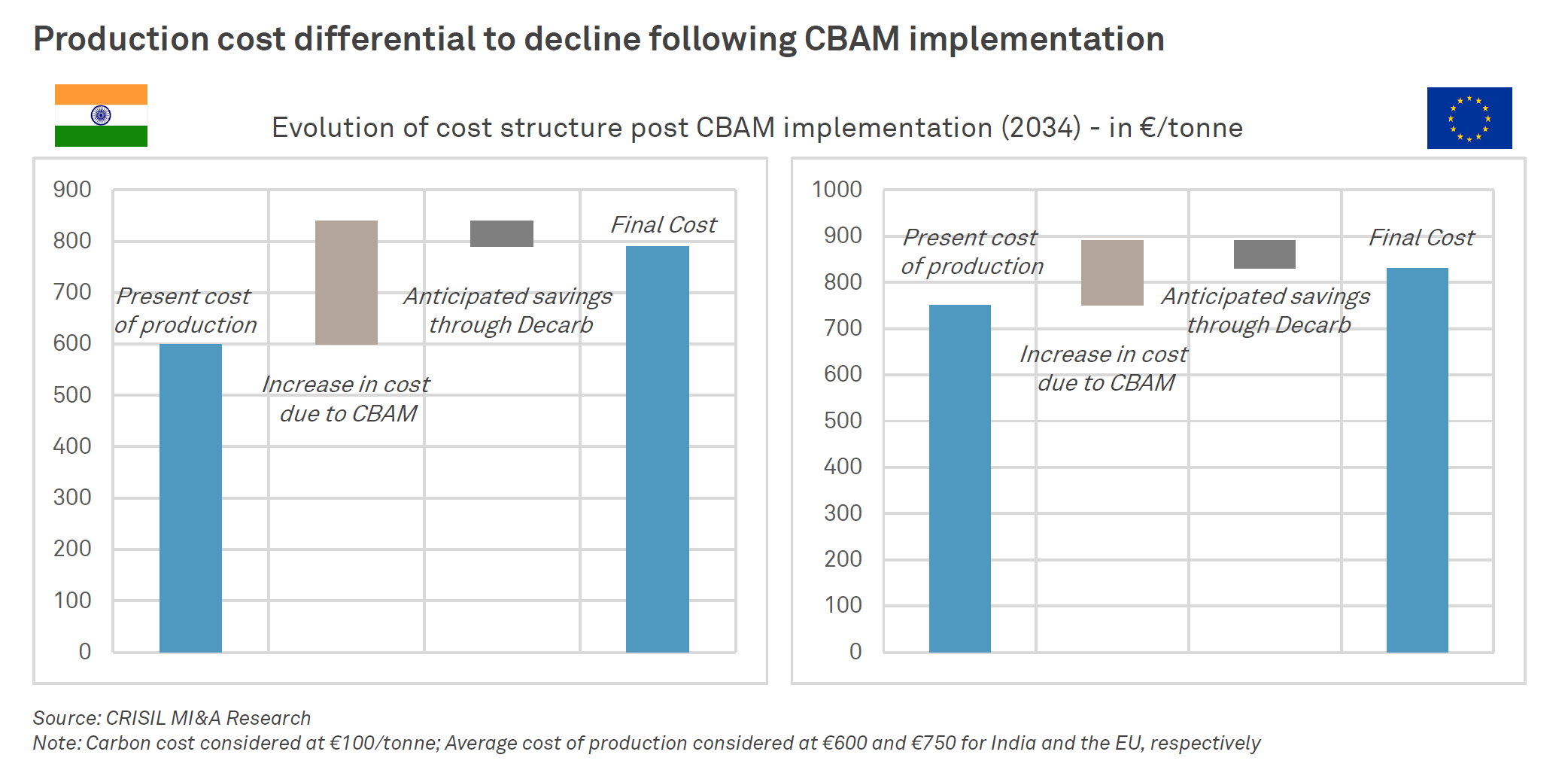

The introduction of the CBAM can significantly increase the financial implications of these carbon emissions for the Indian steel industry. As per the CBAM, imports into the EU will be taxed based on their carbon content, meaning that high-emitting industries like steel will be hit particularly hard. For India, this could mean an additional cost of up to $13 billion annually for its steel exports to the EU, based on current emission levels (1). By 2032, the cost of iron and steel imported into the EU from India could rise by 32%. For example, an EU construction company importing 100 metric tons of Indian steel would pay CBAM costs of €24,600, or 32% of the current price.

Therefore, the adoption of Carbon Capture Solutions becomes critical for the Indian steel industry. Not only can these technologies significantly reduce the industry's carbon footprint, but they also present an opportunity to mitigate the potential financial impact of mechanisms like the CBAM.

Current Efforts in the Indian Steel Industry

The Indian steel industry, recognizing the impending implications of the CBAM and the need for sustainable operations, has already begun taking steps towards decarbonization.

Case Study: Tata Steel and JSW Steel

Leading the way in this transition are companies like Tata Steel and JSW Steel. Tata Steel, for instance, has committed to becoming a carbon-neutral company by 2050 (8). A significant part of this commitment includes the implementation of carbon capture technologies, where CO2 emissions are captured and reused to manufacture chemicals and fertilizers.

JSW Steel, another titan in the industry, has been exploring similar solutions for its operations. The company has planned to invest in green hydrogen technologies and carbon capture and storage (CCS) as part of their decarbonization strategies (9).

Alignment with CBAM

These efforts put forth by Tata Steel and JSW Steel align directly with the requirements of the CBAM. The CBAM seeks to encourage companies in high-emission industries to adopt more sustainable practices by levying a carbon cost on imports from countries without comparable carbon pricing.

By investing in carbon capture technologies and green hydrogen, Tata Steel and JSW Steel are actively reducing their carbon emissions. These reductions can potentially lower the carbon costs that would be levied under the CBAM, ensuring their products remain competitive in key markets like the EU.

Moreover, the CBAM aims not just to reduce carbon emissions but also to stimulate investment in clean technologies (1). The strategies employed by Tata Steel and JSW Steel serve as prime examples of such investment, demonstrating a proactive response to the CBAM's incentives.

Role and Impact of Carbon Capture Solutions

The transition towards a low-carbon economy will hinge on technological advancements that can reduce, capture, and utilize CO2 emissions. One such critical technological group is Carbon Capture Solutions.

Explanation of Carbon Capture Solutions

Carbon Capture Solutions encompass a variety of technologies designed to capture and store or utilize carbon dioxide emissions from large point sources, such as steel manufacturing plants (4). These technologies can broadly be classified into three categories: post-combustion capture, pre-combustion capture, and oxy-fuel combustion (4). Each approach has unique requirements and efficiencies, with current research focused on improving the capture rates and reducing the associated costs (10).

Feasibility and Impact on India's Steel Industry

Implementing Carbon Capture Solutions in India's steel industry is both feasible and impactful. Several studies, including a recent report by the International Energy Agency (IEA), highlight that carbon capture can reduce CO2 emissions from the steelmaking process by up to 90% (11). While implementation costs can be high, the decreasing costs of capture technologies and the potential financial implications of the CBAM make the investment increasingly justifiable.

The implementation of these solutions would not only help reduce the industry's environmental footprint but also pave the way for new markets. Captured carbon can be used in other industrial processes, including the production of chemicals, fuels, and building materials, opening new revenue streams for these companies (12).

Alignment with CBAM through Carbon Capture Solutions

Carbon Capture Solutions directly aid Indian steel manufacturers in better aligning with the CBAM. By significantly reducing their CO2 emissions, these manufacturers can lower the carbon costs that would be levied under the CBAM, thereby maintaining the competitiveness of their products in markets like the EU.

Additionally, these solutions can also demonstrate to the global community India's commitment to climate change mitigation. This commitment could potentially boost the country's standing in international climate negotiations, and further attract investments into its green economy.

Future Directions and Opportunities

The journey towards decarbonization is a complex one, filled with challenges as well as opportunities. As India's steel industry prepares to align with the CBAM, several directions and opportunities emerge that could shape its future.

Role of Government Policies and Support

Government policies and support will play a pivotal role in accelerating the adoption of Carbon Capture Solutions in the steel industry. Regulatory incentives, subsidies for clean technology research and development, and frameworks for carbon pricing could significantly reduce the cost barriers and stimulate investment in these solutions (13).

Moreover, the government can also facilitate partnerships between steel companies, technology providers, and research institutions to foster innovation and fast-track the implementation of carbon capture technologies. Such an integrated approach can ensure the industry's sustainable and competitive future in the CBAM era.

Investment and Innovation Opportunities

The transition towards a low-carbon steel industry also opens up numerous investment and innovation opportunities. Given the industry's size and the pressing need for emission reduction technologies, there is a significant market for innovative Carbon Capture Solutions. Private equity firms, venture capitalists, and public-sector financing can play an instrumental role in driving this innovation and commercialization of technologies (14).

Potential Impact on the Industry and the Country's Economy

The adoption of Carbon Capture Solutions and alignment with the CBAM could have profound impacts on both the industry and the country's economy. By reducing their carbon emissions, Indian steel manufacturers can avoid potential carbon costs under the CBAM, ensuring their products' competitiveness in markets like the EU.

Furthermore, the industry's transition to low-carbon technologies can stimulate economic growth in new sectors, particularly in green technology and renewable energy. It could also create new jobs, driving economic development in regions where these technologies are implemented (15).

Lastly, by aligning with the CBAM, India's steel industry could position the country as a global leader in climate action. This could have far-reaching implications for India's international relations and its standing in future climate negotiations.

Conclusion

As we approach a future where the implications of carbon emissions become more tangible and costly, the need for CBAM alignment becomes crucial for industries globally, especially those with high carbon footprints such as the steel industry. India, being the world's second-largest producer of steel (16), stands at a crossroads where its decisions could have a profound impact on the global climate change narrative.

Importance of CBAM Alignment

The CBAM, aimed at levelling the global economic field and incentivizing carbon reduction, presents both a challenge and an opportunity for India's steel industry. It encourages the industry to adopt sustainable practices and technologies, thus ensuring their products remain competitive in international markets, particularly in the European Union.

Potential of Carbon Capture Solutions

Carbon Capture Solutions emerge as a key player in this transition. By implementing these technologies, the steel industry can significantly reduce its CO2 emissions, opening up new opportunities in terms of regulatory alignment and market competitiveness. These solutions not only enable emission reduction but also can lead to the development of new industrial processes and markets, such as the use of captured carbon in chemical production and building materials.

Role of Gas Lab and the Path Forward

Companies like Gas Lab, specializing in Carbon Capture technology, stand ready to play an active role in this transformative journey. With their technology, retrofittable to existing projects and capable of immediate deployment without scrapping current investments, they can provide the steel industry with the tools it needs to meet the requirements of the CBAM. Through such efforts, Gas Lab is not only supporting the industry's sustainability goals but also significantly contributing to India's broader commitment to mitigate climate change.

In conclusion, the path forward will require concerted efforts from all stakeholders – the government, the steel industry, technology providers like Gas Lab, and the society at large. However, with the potential benefits at hand – economic growth, job creation, international standing, and most importantly, a sustainable and resilient future – the effort is certainly worthwhile.

Reference Links

(1) European Commission. (2021). Carbon Border Adjustment Mechanism.

(4) Global CCS Institute. (2022). What is CCS?

(6) World Health Organization. (2023). Climate Change and Health.

(8) Tata Steel. (2022). Sustainability Report 2022.

(10) International Energy Agency. (2020). Carbon Capture, Utilisation and Storage.

(11) International Energy Agency. (2020). Iron and Steel Technology Roadmap.

(12) Carbon Capture & Storage Association. (n.d.). Uses of CO2.

(13) World Steel Association. (2020). Public Policy and Regulatory Environment.

(14) International Finance Corporation. (2020). Climate Investment Opportunities in Emerging Markets.

(16) World Steel Association. (2022). World Steel in Figures 2022.