The Cost of Carbon Capture in 2025

What Real Plants in India and the Gulf Actually Pay—and Five Levers that can Still Shrink the Bill

Why the Web Still Quotes both US $40 and US $600 Per Tonne

Open two carbon-capture studies and you’ll see numbers that differ by an order of magnitude.

The spread is real, but explainable:

- CO₂ concentration – a cement kiln at 22 % CO₂ is far easier to scrub than ambient air at 0.04 %.

- Heat source & price – waste-heat steam can be almost free; a brand-new auxiliary boiler is not.

- Cost of money – a ten-year loan at 7 % versus 12 % nearly doubles annual cash-out.

The International Energy Agency puts dilute flue-gas capture (power, cement) in the US $40–120 t⁻¹ band, while near-pure streams (ethanol) land below US $25 t⁻¹.

Want to see your plant’s own number—not an industry average?

- Book a 20-min capture-cost call-back

- e-mail sales@ssgaslab.com

- or dial +91-0120-6900219

Dissecting the Bill — Capital Versus Running Cost

| Cost element | 2025 band (India / UAE) | Source |

|---|---|---|

| Plant CAPEX | US $500–700 per annual-tonne (20–50 t d-¹ skids) | IEA project database |

| Low-pressure steam | 3–4 kg steam kg⁻¹ CO₂ (≈ 2.7–3.6 GJ t⁻¹) | Standard MEA duty |

| Electricity | 120–180 kWh t⁻¹ | "Fans, pumps, chillers" |

| Solvent make-up | US $3–7 t⁻¹ | Vendor price sheets |

| Maintenance & labour | 3–5 % of CAPEX yr⁻¹ | O&M benchmarks |

Steam and finance together explain more than half of life-cycle costs so shaving either column moves the needle fastest.

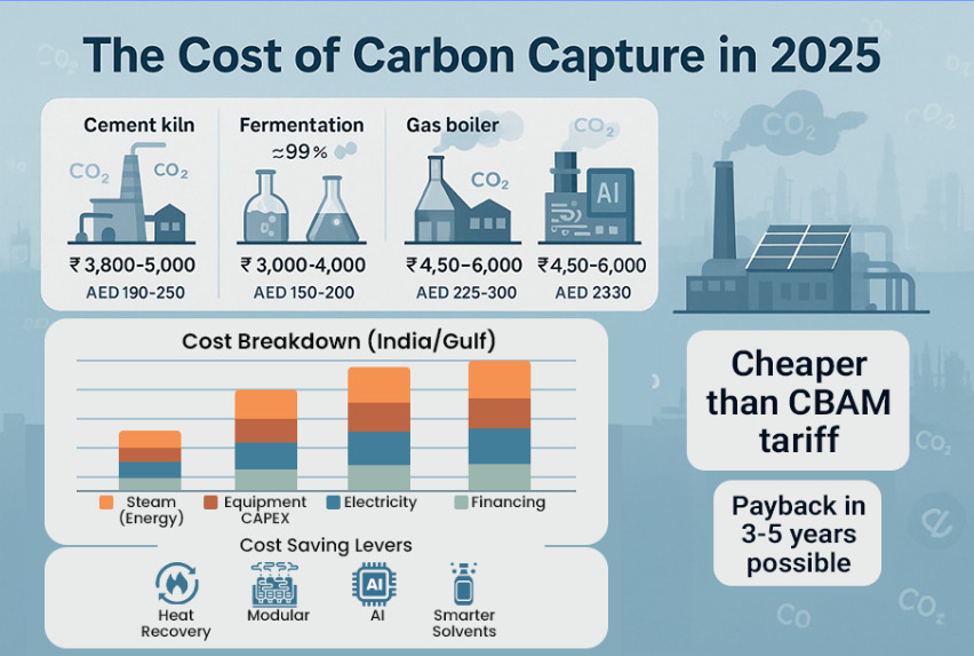

Rupees Versus Dirhams—Real 2025 Price Bands

| Flue-gas stream | India (₹ t⁻¹ CO₂) | UAE (AED t⁻¹ CO₂) |

|---|---|---|

| "Fermentation, ≈ 99 % CO₂" | 3 000 – 4 000 | 150 – 200 |

| "Gas boiler, 8–10 % CO₂" | 4 500 – 6 000 | 225 – 300 |

| "Cement kiln, 22 % CO₂ + WHR" | 3 800 – 5 000 | 190 – 250 |

(₹ 20 ≈ AED 1; assumes 10-year debt at 8 % and 6 000 h yr⁻¹ utilisation.) Liquid CO₂ sold around US $310 t⁻¹ in India at end-2024, setting a clear utilisation ceiling.

Five Proven Levers that Shrink that Number

- Heat-integration – economisers recycle flue heat, trimming 10–15 % steam.

- Smarter solvents – lean-vapour-recompression blends shave a further ≈ 8 %.

- Modular fabrication – factory skids cut EPC overhead 8–12 %.

- AI process control – a refinery twin cut ≈ 100 t d⁻¹ steam (~7–9 %).

- Cheaper money – SIDBI loans at 8 % and Masdar green-bond funds at SOFR + 1.75 % knock ₹ 220–250 t⁻¹ (≈ AED 11–12) off levelised cost.

Need to test any lever against your own steam bill?

- Book a cost review now

- mail or call us

“Will Capture Ever Beat CBAM?” — Quick Math

EU-ETS forward 2027–29 ≈ €85 t⁻¹; CBAM covers 90 % → €76 t⁻¹ effective.

A kiln that emits 0.60 t CO₂ t⁻¹ clinker pays ~€46 t⁻¹ in CBAM certificates, but capture + WHR in India or UAE already clears €35–55 t⁻¹ after tax shields.

Storage or utilisation therefore undercuts the tariff before it even starts.

Two Anonymised Pay-Back Snapshots

| Metric | Beverage-grade plant (Gujarat) | CO₂-EOR skid (Abu Dhabi) |

|---|---|---|

| Capture rate | 25 t d⁻¹ | 40 t d⁻¹ |

| Offtake / credit price | ₹ 4 200–4 800 t⁻¹ | AED 60–150 t⁻¹ |

| Steam source | 100 % waste-heat | "50 % waste-heat, 50 % boiler" |

| Simple pay-back | 4–5 yr | 3–4 yr |

<Heat balances rounded; proprietary data withheld>

FAQ – Five Lines Non-Engineers Ask Most

Will hydrogen prices affect PCC costs?

Not directly. A recent CEEW study shows hydrogen dominates cost for CCU fuels (87 % for SNG), but post-combustion capture costs move mainly with steam and debt until green-H₂ falls near US $1 kg⁻¹.

Is AI worth the hassle at 25 t d⁻¹?

If steam > US $12 t⁻¹, even a 5 % saving pays for a digital twin in < 24 months.

Can Masdar funds cover a small skid?

Yes—local banks bundle < 0.5 Mt projects inside green-loan portfolios.

Key Take-Aways

- Modular PCC skids now cost US $500–700 per annual-tonne.

- 3–4 kg steam kg⁻¹ CO₂ remains the default duty; heat-integration plus AI drives it lower.

- Two points off your interest rate save more than most solvent tweaks.

- Mid-single-digit pay-backs are already happening wherever CO₂ sells above US $50 t⁻¹ or CBAM penalties loom.

Ready for a line-by-line cost review?

- Schedule a 20-min consult

- e-mail sales@ssgaslab.com

- or call +91-0120-6900219

References

- IEA CCUS project cost database (2024 update).

- MEA regeneration duty baseline.

- Liquid CO₂ price trend, India 2024.

- Lean-vapour-recompression solvent trials.

- Digital-twin steam savings case study.

- SIDBI Green-Equipment finance window.

- Masdar Green-Bond on-lending framework.

- CEEW report on hydrogen-driven CCU cost stack.